The SEC's legal battle against Ripple involved coming after them on 2 fronts - first was their claim the company illegally profited by selling an unlicensed security (XRP Tokens) violating the Securities Act of 1933. The second targeted the company's co-founders Christian Larsen and Bradley Garlinghouse, saying they were the ones who made the decisions at the company, so they were charged with "aiding and abettting”.

Today, the SEC's targeting of Larsen and Garlinghouse has officially come to an end as District Judge Analisa Torres announced that the US securities regulator notified the court that it would not continue in the case and has issued a “voluntary dismissal”.

Ripple's lead lawyer Stuart Alderoty shared the news first saying;

"The SEC made a serious mistake going after Brad & Chris personally – and now, they’ve capitulated, dismissing all charges against our executives. This is not a settlement. This is a surrender by the SEC.

That’s 3 consecutive wins for Ripple including the July 13 decision ruling that as a matter of law XRP is NOT a security, the Oct 3 decision denying the SEC’s bid for an interlocutory appeal, and now this." on X.

Current CEO Brad Garlinghouse responded saying;

"In all seriousness, Chris and I (in a case involving no claims of fraud or misrepresentations) were targeted by the SEC in a ruthless attempt to personally ruin us and the company so many have worked hard to build for over a decade.

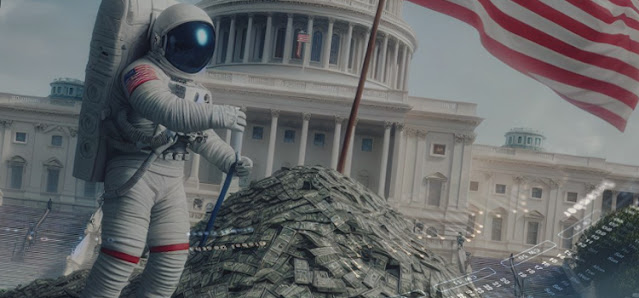

The SEC repeatedly kept its eye off the ball while secretly meeting with the likes of SBF – failing again and again to protect US consumers & businesses. How many millions of taxpayer $ were wasted?! Feels good to finally be vindicated."

FTX a Massive Blemish On An Already Troubled SEC...

The SEC's 'crack down' on crypto has targeted companies like Coinbase, Binance and Ripple - but where are the investors accusing these companies of wrongdoing? Who did Coinbase, Binance, or Ripple scam? You would think reddit and other crypto related forums would be full of these complaints, but when searching for terms that should lead to them, nothing is found.

While the SEC was busy targeting these companies, FTX was actively misusing users funds and behaving suspiciously fearless of being caught. Ironically, it was one of the people under SEC investigation who brought the FTX issue to light - Binance CEO 'CZ'.

This means if CZ had not exposed Sam Bankman-Fried, FTX would still be freely spending their users funds, while their top 2 competitors faced SEC harassment - suspicious to say the least.

It makes you wonder - could SEC deliberately be hiding corruption by appearing ignorant and disorganized?

The Strangest Contradiction...

The most alarming and confusing factor in the SEC's current actions has to be the fact that the SEC evaluated Coinbase just a couple years ago, when they approved the company to go public and sale shares of their stock. This process involves a deep evaluation of the business, and obviously, if a business's main source of income was unlawful, they would not have been approved.

But they were approved. Coinbase even passed a phase where the SEC asked questions about any parts of the business they wanted clarification on, Coinbase answered them, and they were approved.

Nothing has changed since Coinbase was worthy of SEC approval. There's no new leadership at the SEC since they deemed Coinbase's business legitimate just two years ago, Coinbase isn't offering anything now that they were not then. But seemingly out of nowhere, suddenly Coinbase is operating outside of the law.

So SEC saying; just because they approved a company seeking approval to go public and sell share shares on the stock market, it does not mean that company is legitimate - no one has been able to make sense of why the SEC is now undermining themselves in such an extreme way.

Next For Ripple...

While the charges against company founders are dropped, the case against the company itself is still considered ongoing. While the SEC lost on their first attempt, the last statement from them was that they are appealing that decision.

But some say dropping the charges against the founders is a sign they may do the same with the charges against the company - because if the company is guilty, those running it would be as well - it would be odd to drop one and not the other.

-------

Author: Mark Pippen

London Newsroom

GlobalCryptoPress | Breaking Crypto News