VanEck Applies for Ticker Symbol 'HODL' for Proposed Bitcoin ETF...

Major asset management company VanEck filed its fifth amended application for a spot Bitcoin Exchange-Traded Fund (ETF). This move marks a new chapter in the evolution of cryptocurrencies and their integration into mainstream financial markets.

VanEck's proposed ETF will trade under the unique ticker symbol "HODL"...

A widely used term within the Bitcoin community. "HODL" stands for "hold on for dear life" and represents a long-term investment strategy where individuals buy and retain their Bitcoin, unfazed by market volatility. This choice of ticker reflects VanEck's alignment with the core values of the Bitcoin community, emphasizing the long-term potential of the cryptocurrency.

Analysts have offered varied opinions on the "HODL" ticker. Nate Geraci, president of The ETF Store, believes it will resonate well with crypto-savvy investors but might be less intuitive for traditional ones. Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, views it as a bold and unconventional approach, contrasting it with the more conservative choices seen from other firms like BlackRock and Fidelity.

The Companies Racing To Launch their Bitcoin ETF's Are The Largest Financial Intuitions in the World..

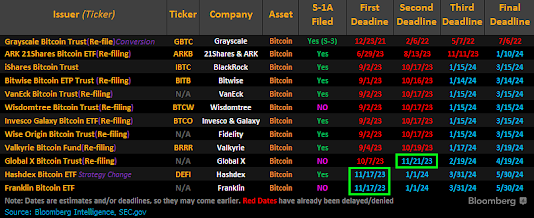

One thing justifying Bitcoin's recent price gains is that the companies interested in launching crypto based ETF's are literally the largest and most powerful financial firms in the world. Several prominent firnms included are BlackRock, Fidelity, Valkyrie, and Franklin Templeton.

While the SEC has yet to provide a clear indication of its stance on these filings, it remains actively engaged in discussions with the firms to address technical aspects of their proposals.

VanEck anticipates SEC approval for its spot Bitcoin ETF as early as January 2024...

They're projecting a potential inflow of $2.4 billion in the first quarter following approval.

This latest move by VanEck signifies a strategic effort to connect with the Bitcoin community and tap into the growing interest in this digital asset. As the regulatory landscape continues to evolve, the anticipation surrounding SEC approval highlights the potential impact such a product could have on the crypto market, potentially making it more accessible and appealing to a wider audience.

-------

Author: Adam Lee

Asia News Desk / Breaking Crypto News