The cryptocurrency world is watching closely this week as the Securities and Exchange Commission (SEC) faces key deadlines to approve or reject several proposed bitcoin exchange-traded funds (ETFs).

Friday marks the deadline for the SEC to make initial decisions on ETF applications from financial firms Hashdex and Franklin Templeton. The regulator could approve the applications, reject them outright, or punt the decision down the road by extending the deadline into 2023.

Another Delay Coming?

According to ETF specialist James Seyffart of Bloomberg Intelligence, there is a "good chance" the SEC will choose the third option and delay the bitcoin ETF decisions until January 2024.

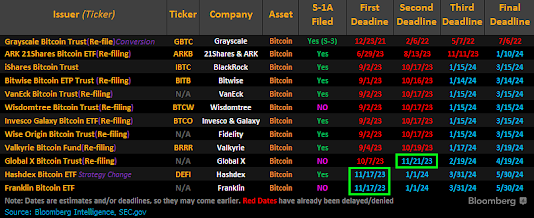

In total, there are 12 pending bitcoin spot ETF applications awaiting judgement by the SEC. The chart below shows the status of the 12 firms applying...

|

| Those in red have already been delayed or denied. |

If Not Now, Soon...

While Bloomberg's James Seyffart predicts a delay this week, he remains optimistic that some bitcoin ETFs will ultimately get approved by January 10th, giving this prediction a 90% chance of happing.

Exploiting the Hype...

However, ETF excitement also led to some market manipulation last week. An unknown actor submitted a fake application for a Ripple (XRP) ETF from Blackrock, briefly causing XRP to spike 10%. The price quickly corrected, but not before causing $5 million in liquidations for XRP leverage traders caught on the wrong side of the swings.

The SEC has yet to approve any cryptocurrency ETFs, repeatedly citing concerns around volatility, manipulation, and adequate oversight. But many investors hope that 2023 could finally be the year bitcoin ETFs get the green light in the US, opening the doors to greater mainstream adoption.

But the SEC faces growing pressure as other countries have already begun approving bitcoin ETFs, further delays would officially put the US behind.

---------------

Author: Oliver Redding

Seattle Newsdesk /

No comments

Post a Comment