The Whales, bitcoin holders who manage between 1,000 and 10,000 Bitcoins, who had sold when the price had topped $30,000, have changed their strategy and are now accumulating.

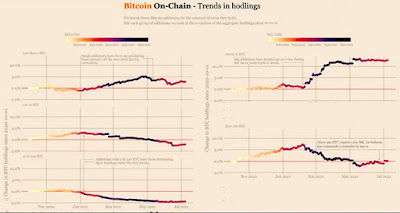

The report from Ecoinometrics compared the activity of seven holder segments over the period of November 2020, starting from those with less than 1 BTC to whales: addresses with less than 1 BTC, 1 to 10 BTC, 10 to 100 BTC, 100 to 1,000 BTC, and 1,000 BTC to 10,000 BTC.

Ecoinometrics says the post-halving bull market really began in October when the price started to take off from the $10,000 price zone.

Ecoinometrics says the post-halving bull market really began in October when the price started to take off from the $10,000 price zone.

|

| The More Bitcoin They Own, The Less They're Selling... |

The document highlights a noticeable difference in the behavior of the BTC in the hands of the so-called fish (with a value of less than 1 BTC) and whales. According to the graph, the group with addresses between 100 BTC and 1,000 BTC has acquired bitcoin with the greatest resolve, especially during the period when the price rose from $30,000 to $60,000.

Top Traders Believe Another Bitcoin Rally Is Around The Corner...

In February, the BTC of whales' addresses began to recede, most likely as a result of profit-taking, but after the price of Bitcoin returned to $30,000, a resumption of accumulation in this segment of large holders has been noted, according to the report.

The study found that profit-taking has already ended in the five groups studied, but the picture has changed since BTC's price stabilized in the $30,000 range.

The study found that profit-taking has already ended in the five groups studied, but the picture has changed since BTC's price stabilized in the $30,000 range.

Whales and small fish have rebounded in value, while other groups have become neutral. As suggested in the study, these first signs of a rebound in value could lead to a return to BTC's increased price growth.

In Glassnode's most recent Bitcoin market report, it is estimated that exchanges send 2,000 BTC per day as net outgoings (being taken off exchanges), which is backed up by on-chain data. This finding is in line with the Ecoinometrics study.

Coins being removed from exchanges and in to private cold storage/secure wallets is a sign of someone confident they won't be selling anytime soon. There never has been more Bitcoin off exchanges than there is now.

-------

Author: Fernando Perez

Latin America Newsdesk

Coins being removed from exchanges and in to private cold storage/secure wallets is a sign of someone confident they won't be selling anytime soon. There never has been more Bitcoin off exchanges than there is now.

-------

Author: Fernando Perez

Latin America Newsdesk

No comments

Post a Comment