"Weird" $100,000 Elon Musk Statue Shows How Far Some Will Go for the CHANCE Musk Will Mention Their Token in Tweet...

Video courtesy of TODAY

Why did Elon Musk's purchase of Twitter include $500 million from Binance, the biggest cryptocurrency exchange in the world?

The exchange platform's creator and CEO, Changpeng Zhao, well known by his alias CZ, explained the decision today.

First, to support international freedom of expression. That is exactly how he sees the social network. He said, "That is something incredibly significant."

Second, Binance likes supporting "excellent entrepreneurs." The CEO of Binance believes that Elon Musk, the founder of firms like Tesla and SpaceX, is a fantastic businessman.

Third, the potential for Twitter to develop into a "super app". Musk himself had previously made a comment about this. Zhao likens WeChat, a Chinese platform that combines a social network, a commerce site, and a way to make payments, to Twitter.

“We want to help bring Twitter to Web3 and help solve problems like charging for subscriptions. Something that could be done very easily globally using cryptocurrencies as a means of payment.” Changpeng Zhao, CEO of Binance added.

CZ rushed in as soon as Musk announced his desire to buy the social network, making little effort to keep their $500 million contribution to the buyout a secret.

---------------

Author: Oliver Redding

Seattle Newsdesk / Breaking Crypto News

Dogecoin, the tenth-largest cryptocurrency with a market cap of $10.5 billion, outperformed any of the other top 50 coins over the last 24 hours, with gains of over 15%.

For the week, DOGECOIN gained nearly 30% and was only outperformed by Telegram's TON token.

Elon Musk's takeover of Twitter nw seems to be a 'sure thing', as the Tesla and SpaceX CEO walked through the doors of the Twitter offices earlier today.

From what we can tell, social sentiment is driving the price, with people assuming Twitter will eventually implement the use of Dogecoin, somehow.

Almost $9 million in Dogecoin futures positions were liquidated over the past 24 hours, almost all by people taking short positions.

The increased attention going to DOGE seems to have spread to its main competitor, SHIBA, which posted gains of around 7%.

A large, seemingly majority of people holding DOGE today appear to be true believers in the coin's long-term potential.

Wallets holding DOGE for more than 1 year are currently at an all-time high of 2.8 million, according to IntoTheBlock.

Also, wallets that buy and sell within a month are at an all-time low - only 132,000 wallets can be considered 'short-term traders' - this is the lowest since mid 2020.

You would think someone with a valid legal case against someone else would happily answer any questions related to it - there's no possibility that simply answering them honestly would end up hurting the case... right?

To be clear - the people behind this lawsuit are aggressively seeking media attention.

Us, along with multiple other outlets have received regular updates on the case in the form of press releases from NY based lawyer Evan Spencer. Both these press release and the lawsuit itself seem to follow a format of initially sounding serious, citing dates and price movements, like it revolves around relatively simple math.

Then things slowly drift, and you find yourself reading 'unhinged' rants, seemingly as the author becomes and more consumed by negative emotions with each mention of the name 'Elon Musk'.

For example, the lawsuit begins with:

"Musk, together with SpaceX, Tesla, Inc., the Boring Company, the Dogecoin Foundation, and the "Doge Army," became de facto partners in a multi-billion-dollar racketeering enterprise which intentionally manipulated the market to drive the price of Dogecoin from $0.002 to $0.73 in two years, an increase of 36,000%. Subsequently, in May of 2022, Musk recklessly caused the price to drop 92% from $.073 to $0.05, an aggregate of nearly $86 billion, when his actions spawned the crypto-crash of 2021/2022."

I'll point out why much of this is misleading; for now, I'm simply showing how the lawsuit sounds like it could be legit...initially.

Like they thought, "Our case is sounding a bit weak... I think we need to turn up the heat - ALL CRYPTO may be EVIL!".

Just like that, you're reading rants about a website that closed 9 years ago when the owners were arrested for selling drugs and other 'black market' goods using Bitcoin as the platform's currency. If you guessed what I'm talking about, you're probably correct - somehow, Silk Road is mentioned in this lawsuit happening nearly a decade later.

"The Silk Road fallout, supra, a now-defunct billion-dollar empire dedicated to the sale of illicit drugs using Bitcoin, further illustrates that crypto’s intended use as currency, in addition to its exploitation as an investment, merits further regulatory scrutiny."

Predictably, no effort was made to see if the 'further scrutiny' already exists - it does. To anyone in crypto, this tactic used to attack crypto is considered outdated and debunked for years - it takes a combination of someone misinformed and desperate to even attempt it.

In reality, about 2.1% of transactions in crypto are connected to something illegal. This is confirmed by the analytics firm that works with the FBI, translating blockchain data into actionable intelligence to catch these criminals, Chainalysis.

According to the UN, as much as 5% of ALL global currency is being used to facilitate something illegal, meaning Fiat currency, specifically paper cash, remains the preferred format of currency in the criminal underworld.

Ironically, they demonstrate an accurate understanding of the public ledger/blockchain behind every cryptocurrency, and how it gives anyone access to a lifelong record of every transaction that was made using that cryptocurrency. But then seem unable to guess why many criminals actually avoid crypto.

Under what circumstances would the party making the accusations against another want to avoid answering questions? If you're the victim, completely innocent, and can clearly explain who victimized you and how they did it - then there is no question that could possibly lead to any other conclusion.

Refusing is a red flag (just my personal opinion, of course, it isn't a definitive sign that something shady is going on), but I cannot think of any time in my life when I was confident enough to accuse someone of something negative, but scared someone could ask a question that would result in my claims sounding invalid.

It's worth noting that before the lawyer read them, he said he would have a response for me the following day. When the following day came, he said they could not answer questions. Specifically telling me:

"I am not at liberty to answer any of your direct questions at this time. After the case is fully pleaded and briefed with the district court, I would be happy to let you interview me and some of my clients.

However, until that time, I cannot compromise the rights and interests of my clients to appease the demands of the media."

Also worth noting, there were only 2 questions. The team came up with something like 10 legitimate things to ask, but in the end we all agreed that the validity of the case would be determined by these 2 factors.

Elon Musk first mentioned Dogecoin in a 2019 tweet. Anyone who bought it then is STILL up 2900% on their investment. Elon Musk has mentioned it occasionally ever since.

So let's go with the idea that your client truly admired Elon Musk, which is why Elon mentioning something was so persuasive. But if that was the case, the timeline is very off.

Your client could have lagged a full 20 months after Musk first mentioned Dogecoin, and if he bought some then, his profits would be over 500% still today.

But your client waited 2 years or more to act on Musk's endorsement.

Can you explain how Elon Musk's endorsement was both irresistible to your client, and at the same time, something they didn't get around to doing for nearly 2 years?

Has Elon Musk sold ANY Dogecoin? He said he hasn't.

There's been no mention of a mysterious wallet dumping massive amounts of Dogecoin, suspected to belong to Elon.

Not only does he claim to have never sold, he says he's bought more as the price declined.

Your lawsuit frames him as a scammer running a pyramid scheme, but if he's telling the truth, this would be the first time in history the mastermind behind the multi-million dollar scam forgot the most important part - to profit.

What is your evidence that Musk did indeed profit? Otherwise, his investment lost an even higher percentage as your client - this has never been said about the person at the top of a pyramid scheme before.

Because it appears that Elon's endorsement of Dogecoin was NOT so influential that those suing him felt compelled to buy some when they found out he was a fan. More like they saw/heard Elon was a fan of Dogecoin, reacted by doing literally nothing for an extended period of time, then nearly 2 years after Musk first spoke of it, bought some Dogecoin.

Now the only remaining claim revolves around the idea that Elon manipulated the price of Dogecoin for personal gain - but as far as anyone knows, he hasn't gained a penny.

If Elon is telling the truth, that he sold none, and even bought more as the price declined - the entire lawsuit becomes impossible to make sense of, none of Musk's actions fit their claims.

The lawyer representing those suing Musk did however agree to speak with us 'After the case is fully pleaded and briefed with the district court' - we may have all our answers by then, if not, we will take them up on the offer.

-----------

Author: Ross Davis

Silicon Valley Newsroom

GCP | Breaking Crypto News

--We would prefer that you buy some more #bitcoin.

— Michael Saylor⚡️ (@saylor) August 17, 2022

Tesla, the US electric car manufacturer, released more details about why it invests in bitcoin (BTC). This is no small investment either, as Tesla currently holds 42,902 BTC making them the 2nd largest Bitcoin holder of all companies globally, with MicroStrategy the largest. However, it's worth noting that MicroStrategy is a company that exists to invest in digital assets.

These new disclosures on Tesla's belief in crypto come in their latest quarterly report filed with the SEC, where they state:

"In the first quarter of 2021, we invested an aggregate $1.50 billion in bitcoin. We believe in the long-term potential of digital assets both as an investment and also as a liquid alternative to cash. As with any investment and consistent with how we manage fiat-based cash and cash-equivalent accounts, we may increase or decrease our holdings of digital assets at any time based on the needs of the business and our view of market and environmental conditions.

Digital assets are considered indefinite-lived intangible assets under applicable accounting rules. Accordingly, any decrease in their fair values below our carrying values for such assets at any time subsequent to their acquisition will require us to recognize impairment charges, whereas we may make no upward revisions for any market price increases until a sale. For any digital assets held now or in the future, these charges may negatively impact our profitability in the periods in which such impairments occur even if the overall market values of these assets increase. For example, in the first quarter of 2021, we recorded approximately $27 million of impairment losses resulting from changes to the carrying value of our bitcoin and gains of $128 million on certain sales of bitcoin by us."

Their crypto investments come up once again in the document, where companies are required to disclose any risks to the business. It's important to understand this section is where a company gives the absolute worst case scenario to investors. Here, Tesla included everything from being unable to make more batteries because of material shortages, to hackers being able to 'gain control of' their vehicles and the public panic it would cause.

So, with that tone in mind, they explained the risks they take by holding crypto, saying:

"In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity, allowing us to invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future. Thereafter, we invested certain of such cash in bitcoin. We believe in the long-term potential of digital assets both as an investment and also as a liquid alternative to cash. As with any investment and consistent with how we manage fiat-based cash and cash equivalent accounts, we may increase or decrease our holdings of digital assets at any time based on the needs of the business and on our view of market and environmental conditions.

The prices of digital assets have been in the past and may continue to be highly volatile, including as a result of various associated risks and uncertainties. For example, the prevalence of such assets is a relatively recent trend, and their long-term adoption by investors, consumers and businesses is unpredictable. Moreover, their lack of a physical form, their reliance on technology for their creation, existence and transactional validation and their decentralization may subject their integrity to the threat of malicious attacks and technological obsolescence. Finally, the extent to which securities laws or other regulations apply or may apply in the future to such assets is unclear and may change in the future. If we hold digital assets and their values decrease relative to our purchase prices, our financial condition may be harmed."

In other words, fairly common fears like potential security threats, which have hit companies far more experienced in holding large amounts of crypto. Another risk highlighted is the the possibility of future government regulation, which could hurt the whole ecosystem if poorly implemented or too broad.

So far, even with the latest dips, Tesla is well into the profit zone. They acquired their Bitcoin in January 2021, when prices were as low as $29,000 and peaked at $34,000.

At the time of publishing, Bitcoin is trading at $38,350, meaning their profits are a minimum of $186,623,700.

So, where things currently stand, Tesla has no regrets.

-------

Author: Mark Pippen

London News Desk

Breaking Crypto News

|

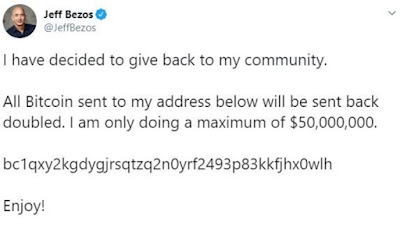

| Amazon CEO Jeff Bezos |

|

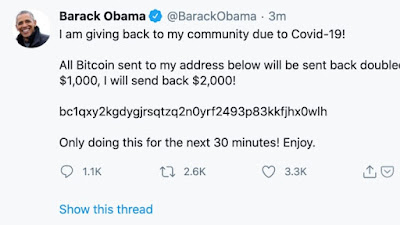

| Even The Former President was targeted... |

|

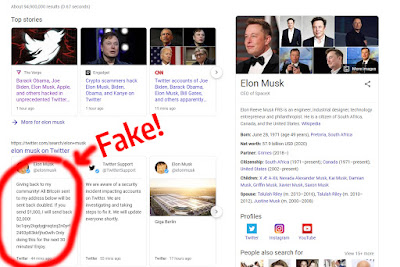

| Fake tweet is still displayed as legitimate on Google. |